Application Tool / Status Bar Calls

This Application is called by clicking the Application tool-bar push button: On-Charge.

Mandatory Prerequisites

Prior to entering a Manual On-Charge, refer to the following Topics:

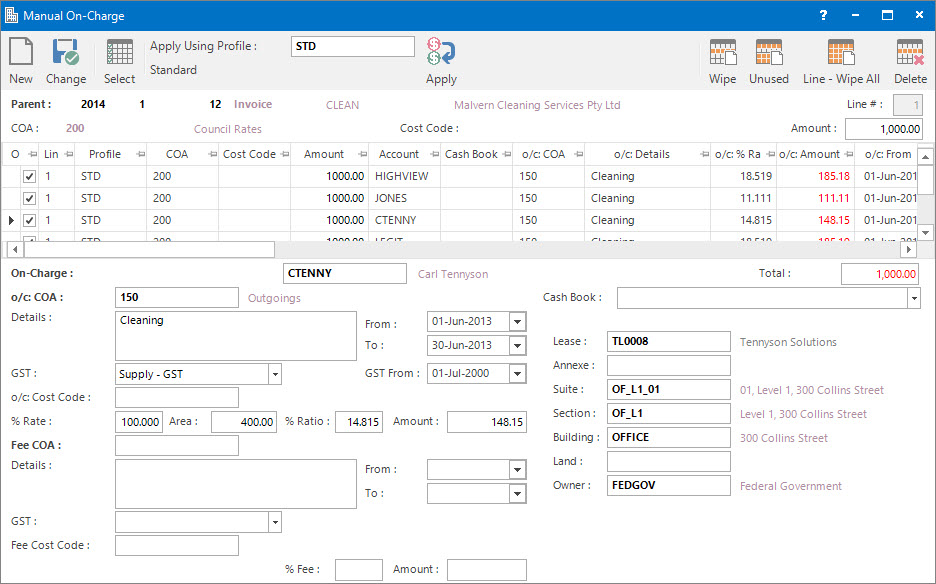

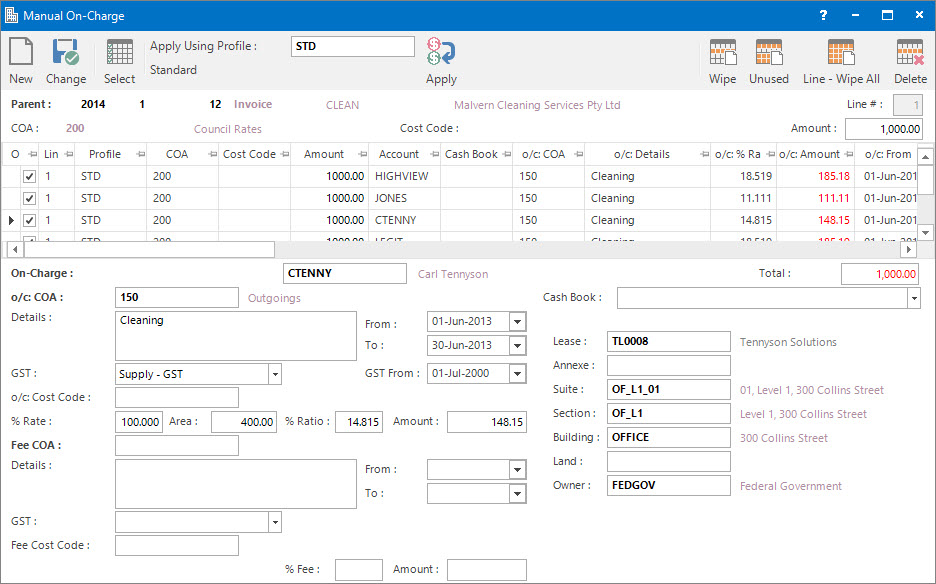

Screenshot and Field Descriptions

Embedded in Tool-Bar

Apply Using Profile: this is the On-Charge Profile to apply. It define the rules for apportioning on-chargeable Creditor Transactions to Tenants.

Parent Transaction Fields

These fields display the Year, Period, Number, Transaction Type and Account of the Creditor transaction being on-charged.

On-Charge Lease Lines Apportionment

The fields above the On-Charge Lease Lines Apportionment table display the Creditor transaction line item values for Line #, COA, Cost Code and Amount. These will populate when a row in the grid is double clicked.

On-Charge Lease Lines Apportionment table: when the Application tool-bar push button: Select is clicked this grid will be populated with Tenants who lease areas in the property that the Creditor transaction relates to.

GST lines can not be on-charged therefore will not show. GST will be created on the Tenant transactions based on the GST Type of the On-Charge - COA.

The check box in the O (On-Charge) column can be ticked to include / exclude Tenants in the apportionment. The apportionment on all other rows will automatically be re-calculated. Any excluded lines can be cleared from the grid by clicking the Right Hand Side Application tool-bar push button: Wipe Unused.

Double click a row to populate the fields below the table for editing.

Year / Period / Number: this will display the number of the Tenant transaction once it has been raised through the On-Charge processing screen.

Account: this is the Tenant (Lease a/c) that the transaction is to be on-charged to.

COA

o/c: COA: this is the Chart of Account (usually Income) that the amount will be on-charged to in the Tenant transaction. It will default to the value set up on the On-Charge Profile.

Details: this is a free format, optional detail associated with the transaction line to be created. It will default to the value set up for the COA.

From: this is the From date for the transaction line to be created. It will default to the From date of the Creditor transaction being on-charged.

To: this is the To date for the transaction line to be created. It will default to the To date of the Creditor transaction being on-charged.

GST: this is the GST Type for the transaction line to be created. It will default to the value set up on the On-Charge Profile.

GST From: this is a historical field and current use is now irrelevant.

o/c: Cost Code: this is the Cost Code for the transaction line to be created. It will default to the value set up on the On-Charge Profile.

% Rate: this specifies how much of the amount to on-charge. It will default to the value set up on the On-Charge Profile.

Area: this is the area leased by the Tenant. It can be changed to alter the apportionment if required.

% Ratio: this is the calculated percentage of leaseable property area for the Tenant. This field is referential only.

Amount: this is the amount that will be on-charged. It is calculated from the Creditor transaction amount x % Rate x % Ratio. It may be overridden if required.

Fee

Fee COA: if an additional handling fee is going to be charged, this is the Chart of Account that will be used. It will default to the value set up on the On-Charge Profile.

Details: this is a free format, optional detail associated with the additional fee to be charged. It will default to the value set up for the Fee COA.

From: this is the From date for the additional fee to be charged. It will default to the From date of the Creditor transaction being on-charged.

To: this is the To date for the additional fee to be charged. It will default to the To date of the Creditor transaction being on-charged.

GST: this is the GST Type for the additional fee to be charged. It will default to the value set up on the On-Charge Profile.

GST From: this is a historical field and current use is now irrelevant.

Fee Cost Code: this is the Cost Code for the additional fee to be charged. It will default to the value set up on the On-Charge Profile.

% Fee: this is the percentage of the on-charged amount to raise as an additional fee. It will default to the value set up on the On-Charge Profile.

Amount: this is the additional fee amount. It is calculated from the amount that will be on-charged x % Fee. It may be overridden if required.

Cash Book: this is the Bank account if the Tenant transactions raised are going to be a Cash Sales / Cash Credit type transaction. Leave blank if a Invoice / Credit Note type transaction is to be raised.

Lease: this is the On-Charge Lease ID. It may be overridden.

Annexe: this is the On-Charge Annexe ID. It may be overridden.

Suite: this is the On-Charge Suite ID. It may be overridden.

Section: this is the On-Charge Section ID. It may be overridden.

Building: this is the On-Charge Building ID. It may be overridden.

Land: this is the On-Charge Land ID. It may be overridden.

Owner: this is the On-Charge Owner ID. It may be overridden.

How Do I : Search For and Maintain Entities

These General Rules are described in the Fundamentals Manual: How Do I : Search For and Maintain Entities

How do I : Add a Manual On-Charge

How Do I : Modify an existing Manual On-Charge

How Do I : Delete an existing Manual On-Charge

A Manual On-Charge record can only be deleted if there are no raised transactions associated with it.

Manual On-Charge is associated with the following Topics: